Stories of Impact

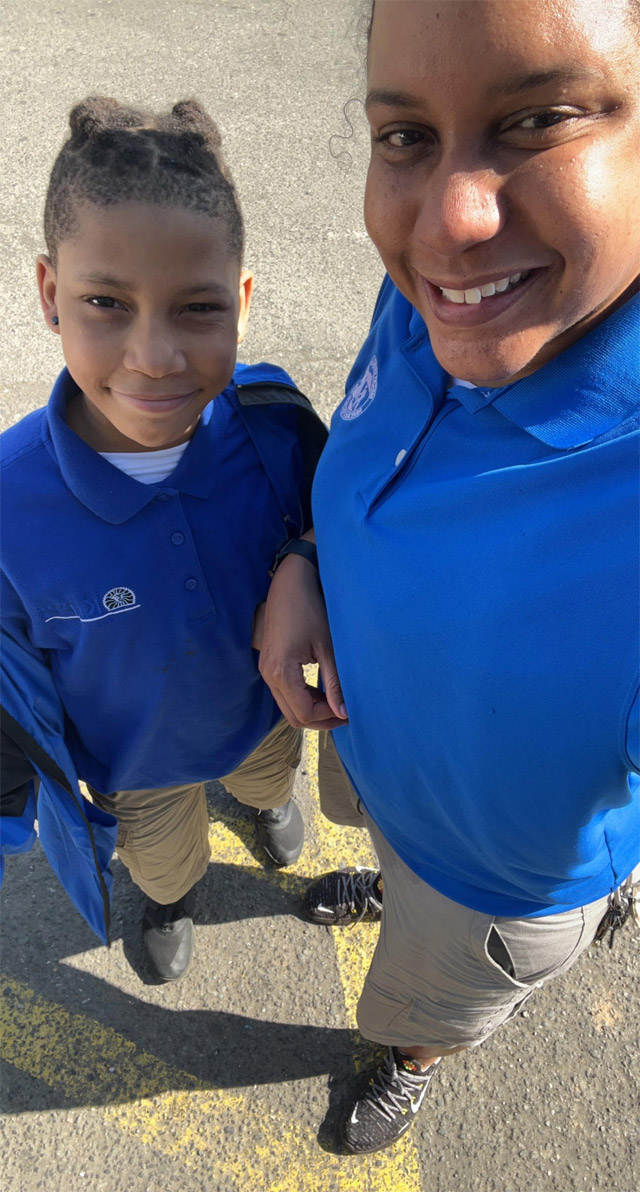

Shawna Mayo, Pride of 2012

Shawna Mayo, Pride of 2012, returned to her pride as the first graduate to lead a KIPP North Carolina school as principal of KIPP Gaston College Preparatory Middle. After graduating, Shawna attended Elon University, where she earned a degree in psychology.

"I’ve never seen myself in school leadership, let alone being a middle school principal. I’m just thankful for all the mentors I’ve had along the way. I want to be a constant reminder for students what is possible in the area. Representation is very dear to me. I think students deserve to see diversity in their school environment and just other models of what is possible at their fingertips as long as they strive for academic excellence and their authentic selves."

Kelby Hicks, Pride of 2010

Kelby Hicks is a KIPP GCP Pride High School 2010 alumnus, and a board member for KIPP North Carolina, and A Better Chance A Better Community.

After leaving Pride High, Kelby went on to earn a bachelor’s degree from North Carolina A&T State University and a law degree from Elon University School of Law. He is a business and real estate associate with Raleigh Real Estate Law in North Carolina. Kelby ran for election to the North Carolina House of Representatives to represent District 27. Kelby participated in the KIPP Leadership Accelerator, a nationally recognized development program in partnership with Management Leadership for Tomorrow, which he credits for his focused personal and professional success.

“For diverse professionals desiring a strong foundation upon which to build leverage and launch themselves into leadership, the right coach can provide the blueprint. By myself, I walked toward my future. With a coach, I’m on a private jet flying toward my dreams. My privilege as a KIPP alumni granted me the chance for a coach, but more paths need to be opened."

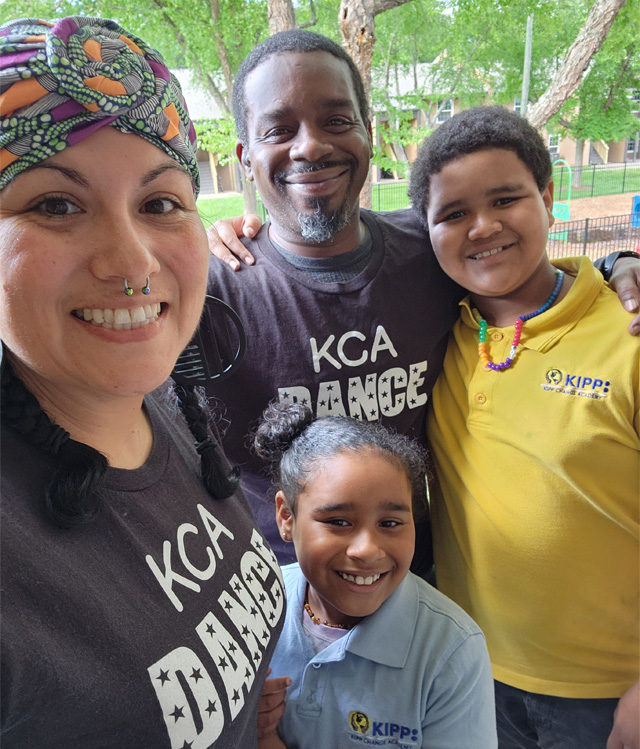

Anthony and Courtney Reese, and KIPP NC children

Anthony and Courtney Reese might be considered “OG” KIPP North Carolina parents. They became a KIPP Charlotte family in 2013 when Courtney enrolled her oldest son Roman, now 20, at KIPP Academy Charlotte on Wilann Drive.

Courtney, a professional chef and baker, said she and her husband take their children’s education seriously. So, when it was time to prepare their younger children – Carlos, 9, and Carleigh, 7 – for their education, the Reeses had no doubt that KIPP Academy’s sister school, KIPP Change Academy in Charlotte, would be the only choice.

KIPP Change was founded in 2016 by veteran educator, and former KIPP Academy math teacher and school administrator, Malcolm Brooks. Courtney said that Malcolm’s holistic, community-centric approach to teaching and leading makes her a proud KIPP Change mom and advocate. Even when the Reeses experienced a fire that left the entire family unhoused a few years ago, Malcolm and the KIPP Change team sprung into action to assist – from providing food and school uniforms to making sure that the family had transportation to important meetings.

My oldest went to a (Charlotte-Mecklenburg) elementary school…and when I saw (KIPP Academy was) enrolling for 5th (grade), my prayers had been answered! I had been disappointed in my experience with the staff at Roman’s former district school who overlooked bullying and even hid it from me and my husband. As a result, Roman’s academic performance and progress deteriorated. I didn't feel CMS provided a well-rounded education.

I recommend KIPP (Charlotte) to all my mom friends…because it sets the bar so high for getting an excellent education from genuinely caring teachers and staff.

Caiden Obie Found a School Especially for Him

Caiden Obie has a bright, beautiful smile. But his parents, Zel Pardo and Laura Jones, knew that he wouldn’t be able to maintain the happiness behind that smile if she kept him in a traditional public school setting.

Because Caiden is on the autism spectrum, Zel and Laura wanted to find an education homeplace for their son where he would receive the lessons and unique support he needs and deserves that will prepare him for life beyond the classroom. Before transferring to KIPP Academy Charlotte, Caiden was a fourth grade student in a Charlotte-Mecklenburg elementary school.

Caiden has successfully finished his first year as a KIPPster and will begin his journey as a KIPP Academy sixth grader in Fall 2023.

Zel said that the instructional and support staff at KIPP Academy have created an environment for Caiden in which he can feel confident both academically and socially. She and Laura specifically credits Exceptional Children teacher Christopher Bloom, and 5th grade math teacher Michael Mebane, with Caiden’s first-year success.

“In my opinion, [Caiden] was getting lost in the public school environment. The parent-teacher relationship became strained due to lack of alignment and communication.

I was attracted to KIPP North Carolina once I was informed of the fifth grade classroom dynamic. The classrooms are smaller and geared towards assisting children with special needs independently. The individualization of meeting every child where they are, compounding on their current skill levels, was very attractive to me as a parent.

Our most transformative experience would have to be Caiden’s energy and enjoyment towards his learning environment. He…enjoys spending time with his peers, teachers, and is showing more focus and understanding with his educational tasks.

KIPP is doing amazing things. Keep up the good work!”